The Perils of Using AI For Wealth Management

I tested ChatGPT's financial advice for two months. What I found was the opposite of what I expected

How can we tap into the power of AI to manage our financial wealth in a way that leads to a more meaningful, joyful, and fulfilling life? Over the past couple of months, I have been experimenting to see what it can and can’t do.

I used ChatGPT, a computer program that simulates human conversation and can be accessed through a web browser or via apps. I thought AI would deliver precise math models but provide stiff and off-kilter recommendations for emotionally nuanced situations. To my surprise, the opposite often happened.

What follows is my advice based on what AI can do today - not what it might do tomorrow.

Don’t Use AI for Financial Projections

I tested AI’s ability to run projections on retirement and college savings. It seemed like the kind of task AI would excel at—just give it the right inputs and let it crunch the numbers.

That’s not what happened.

Sometimes the answers were correct. Other times, they were wrong—wildly wrong. And they were always delivered with a tone of absolute certainty.

As a wealth manager for many years, I have a deep understanding of how financial projections work and clients learned they could depend on my knowledge. But without that training, you’d have no way of knowing whether AI’s projections are reliable.

Don’t Rely on AI Alone for Financial Advice

AI-generated financial advice is often problematic. Sometimes it’s needlessly complex and confusing. Sometimes it’s correct but incomplete.

Let me illustrate with a fictional example of a retired couple, both of them 70. They have a paid-off home, Social Security income, and a $3 million portfolio—$2 million in traditional IRAs and $1 million in a taxable account split among highly appreciated equity index funds, bond funds with almost no gains, and money markets.

They decide to give their son $200,000 for the down payment on a home. I asked AI where’s the best place among their investments to pull the money from. AI gave a tax-sensitive response: pull from the cash and bonds in the taxable account to avoid income taxes and capital gains taxes.

That sounds good, until you realize the response gave no consideration to the couple’s portfolio’s structure. Draining their cash and bonds could leave the couple exposed, potentially forcing them to sell stocks during a downturn to meet living expenses.

Worse, AI added unnecessary complexity. It raised concerns about federal gift and estate taxes—even though this couple’s nest egg is nowhere near the thresholds where those taxes apply.

AI Doesn’t Consider the Big Picture

When clients asked me tactical questions, like how best to withdraw $200,000 from their portfolio, I’d zoom out first. How does this decision fit into the broader picture of their lives?

If this couple had called me, I would have reminded them they recently started spending $3,000 a month to support the wife’s aging parents, and they have complained about feeling financially stretched. From my perspective, they have three important and competing goals: their lifestyle and travel plans, supporting her parents, and helping their son buy a home. Giving their son $200,000 leaves considerably less money to support her parents or take that dream vacation.

My counsel would be that they need to figure out which of these three goals matters most to them. We would work through together how much money they need to set aside for each goal. After this analysis, they might still give their son the same amount, or maybe decide half as much or even nothing was more appropriate.

Those are nuances that depend on the give and take of human conversation.

AI will answer the question you ask. It won’t help you figure out the question you should be asking.

AI’s Advice May Not Be in Your Best Interest

Suppose you ask AI whether to withdraw the $200,000 for the son’s house or borrow against your investment portfolio. It might recommend a loan to avoid triggering capital gains taxes. That could be wise—or a mistake—depending on your comfort with debt, the loan’s interest rate, your available collateral, and whether you have capital loss carryforwards.

What you won’t know is whether AI is programmed to subtly steer you toward a margin loan because it’s more profitable for the brokerage firm.

You Can’t Intuit AI’s Intentions

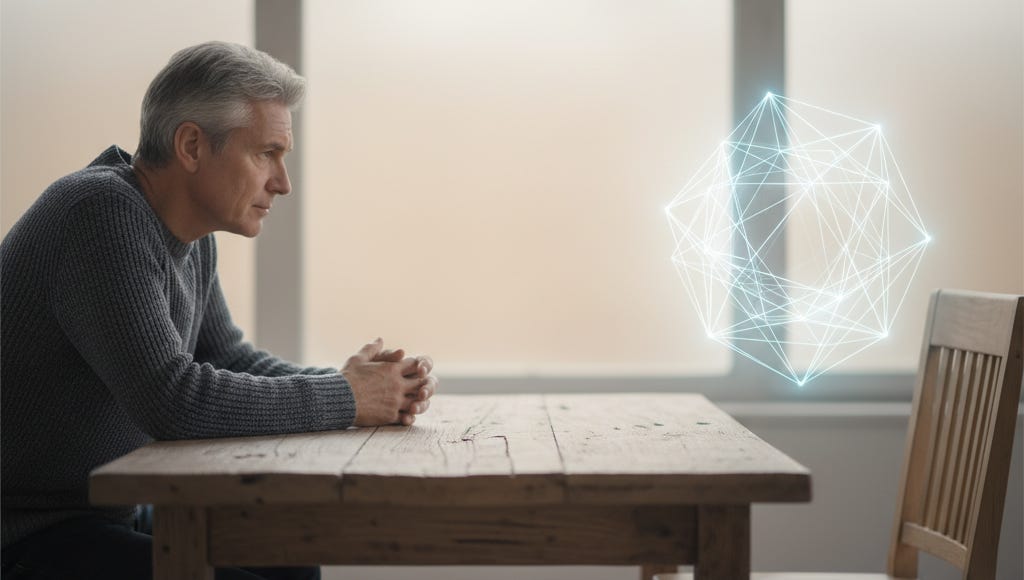

Exceptional wealth management is a human-to-human relationship. It’s built on trust, care, competence, and nonjudgmental listening. A great advisor puts your interests first—and you can feel it.

If your advisor starts giving self-serving advice, you are likely to notice. They’ll look uneasy. Their answers will feel off. You’ll get a gut sense that something’s wrong.

With AI, those subtle warning signs don’t exist. There’s no unease to detect. No facial expression. No body language. AI has no emotions, no soul, no loyalty. It’s a tool programmed by people—and those people may or may not have your best interests at heart.

Big companies are investing heavily in AI. It’s reasonable to expect that many will design AI tools that give advice aligned with their profit motives.

Proceed with Caution

I want to emphasize that, in time, developers will solve some of the issues I highlight above, and new challenges will emerge.

Although I am sounding a warning about misleading or just plain wrong outcomes, I do not doubt that AI offers benefits for your wealth management needs. It can help you engage in more productive conversations with your advisor, better understand your investment plans, and even communicate with family around sensitive financial issues.

All of that will be the focus of my next blog.

Until our next conversation,

David

Small Steps & Worthy Questions

Have you ever trusted a tool—technological or otherwise—only to realize later that what you really needed was wisdom, not just information?